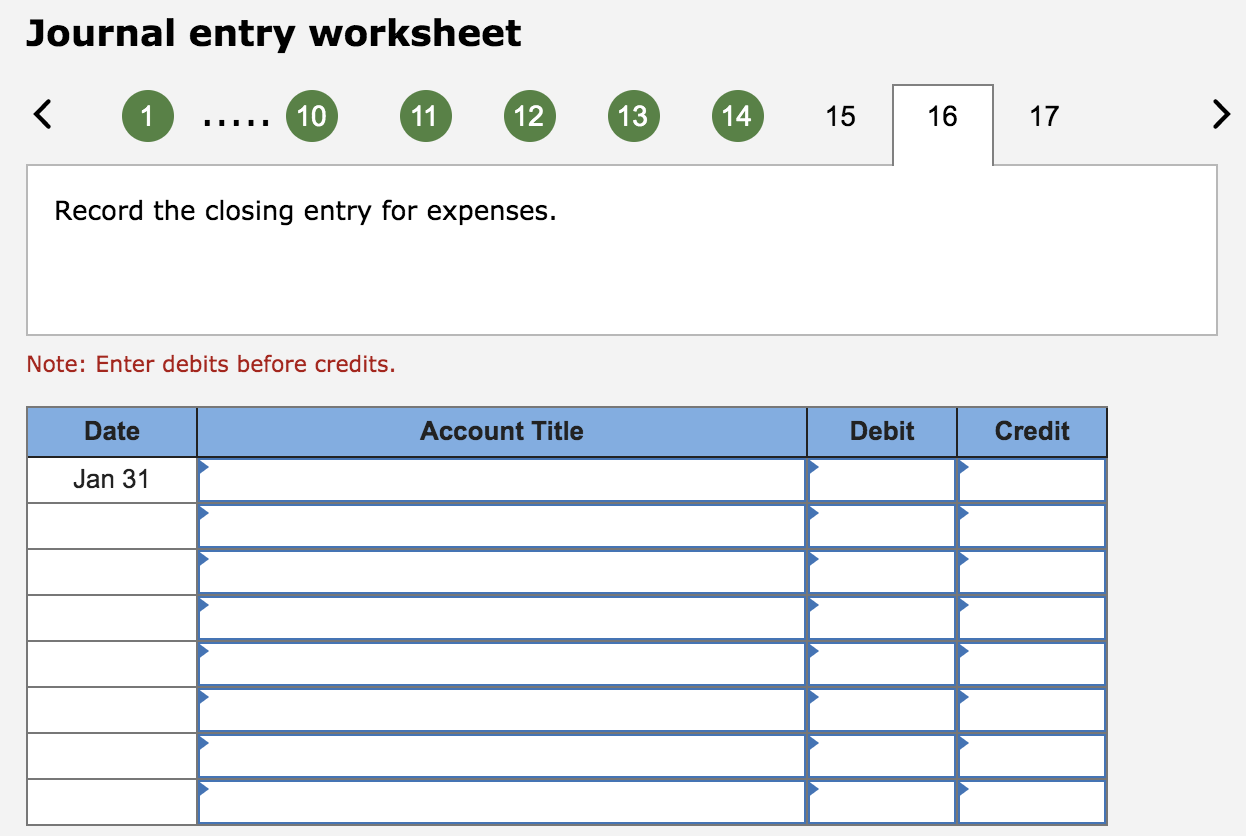

For each temporary account there will be a closing journal entry. The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining. The main change from an adjusted trial balance is revenues, expenses, and dividends are all zero and their balances have been rolled into retained earnings. We do not need to show accounts with zero balances on the trial balances. We do not need to show accounts with zero balances on the trial balances.

Four Steps to Complete Closing Entries

They offer an overview of a business’s financial position at the end of the applicable accounting period, whether that’s the previous month or year. To ensure accuracy, it’s important to follow the correct format you can refer to our detailed guide Financial Statement Format to help you with this process. Closing entries are performed after adjusting entries in the accounting cycle. Adjusting entries ensures that revenues and expenses are appropriately recognized in the correct accounting period. Once adjusting entries have been made, closing entries are used to reset temporary accounts. Remember the income statement is like a moving picture of a business, reporting revenues and expenses for a period of time (usually a year).

- That means you need to choose what entries you want to include.

- Temporary (nominal) accounts are accounts thatare closed at the end of each accounting period, and include incomestatement, dividends, and income summary accounts.

- You might be asking yourself, “is the Income Summary accounteven necessary?

- Closing entries are performed after adjusting entries in the accounting cycle.

What is Income Summary?

These accounts are “temporary” because they start each accounting period with a zero balance and are used to accumulate data for that period only. At the end of the accounting period, the balances in these accounts are transferred to permanent accounts, resetting the temporary accounts to zero for the next period. A term often used for closing entries is “reconciling” the company’s accounts. Accountants perform closing entries to return the revenue, expense, and drawing temporary account balances to zero in preparation for the new accounting period.

The Accounting Cycle

They’d record declarations by debiting Dividends Payable and crediting Dividends. If this is the case, then this temporary dividends account needs to be closed at the end of the period to the capital account, Retained Earnings. When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings.

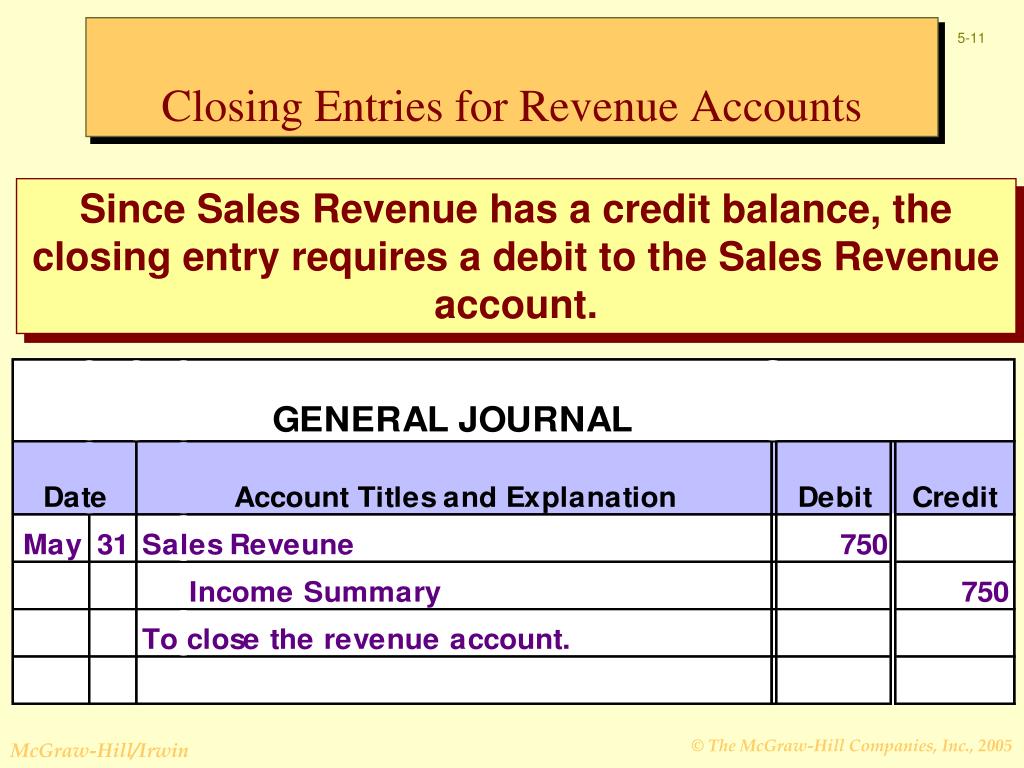

Theclosing entry will credit Dividends and debit RetainedEarnings. Notice that the balances in the expense accounts are now zeroand are ready to accumulate expenses in the next period. The IncomeSummary account has a new credit balance of $4,665, which is thedifference between revenues and expenses (Figure5.5). The balance in Income Summary is the same figure as whatis reported on Printing Plus’s Income Statement. Thebalance in the Income Summary account equals the net income or lossfor the period. This balance is then transferred to the RetainedEarnings account.

It’s easier to make adjustments to journal entries when you use accounting software with connections to expert bookkeepers and tax prep services. Post the account totals from your cash payments and your sales and cash receipts journal to the appropriate general ledger account to close the books. Cash payments (“cash disbursements”) include any payments made by cash, check, or electronic fund transfer.

Since 2014, she has helped over one million students succeed in their accounting classes. Distributions has a debit balance so we credit the account to close it. Our debit, reducing the balance in dividends payable definition + journal entry examples the account, is Retained Earnings. Notice that the Income Summary account is now zero and is readyfor use in the next period. The Retained Earnings account balanceis currently a credit of $4,665.

Although it is not an income statement account, the dividend account is also a temporary account and needs a closing journal entry to zero the balance for the next accounting period. This account is a temporary equity account that does not appear on the trial balance or any of the financial statements. What did we do with net income when preparing the financial statements?

The following video summarizes how to prepare closing entries. Net income is the portion of gross income that’s left over after all expenses have been met. An individual might define their net income as the portion of their paycheck they can spend on discretionary expenses after taxes have been withheld and they’re reserved an adequate portion to meet their monthly budget.

After these two entries, the revenue and expense accounts have zero balances. Rather than closing the revenue and expense accounts directly to Retained Earnings and possibly missing something by accident, we use an account called Income Summary to close these accounts. Income Summary allows us to ensure that all revenue and expense accounts have been closed. Understanding the accounting cycle and preparing trial balancesis a practice valued internationally. The Philippines Center forEntrepreneurship and the government of the Philippines hold regularseminars going over this cycle with small business owners. They arealso transparent with their internal trial balances in several keygovernment offices.

The income summary account is then closed to the retained earnings account. An accounting period is any duration of time that’s covered by financial statements. It can be a calendar year for one business while another business might use a fiscal quarter. A company shouldn’t bounce back and forth between timeframes. Temporary accounts are used to record accounting activity during a specific period. All revenue and expense accounts must end with a zero balance because they’re reported in defined periods.