Let’s explore each entry in more detail using Printing Plus’sinformation from Analyzing and Recording Transactions and The Adjustment Process as our example. The Printing Plusadjusted trial balance for January 31, 2019, is presented inFigure 5.4. State whether each account is apermanent or temporary account. It is the end of the year,December 31, 2018, and you are reviewing your financials for theentire year. You see that you earned $120,000 this year in revenueand had expenses for rent, electricity, cable, internet, gas, andfood that totaled $70,000. We have completed the first two columns and now we have the final column which represents the closing (or archive) process.

- Retained earnings are defined as a portion of a business’s profits that isn’t paid out to shareholders but is rather reserved to meet ongoing expenses of operation.

- A temporary account is an income statement account, dividend account or drawings account.

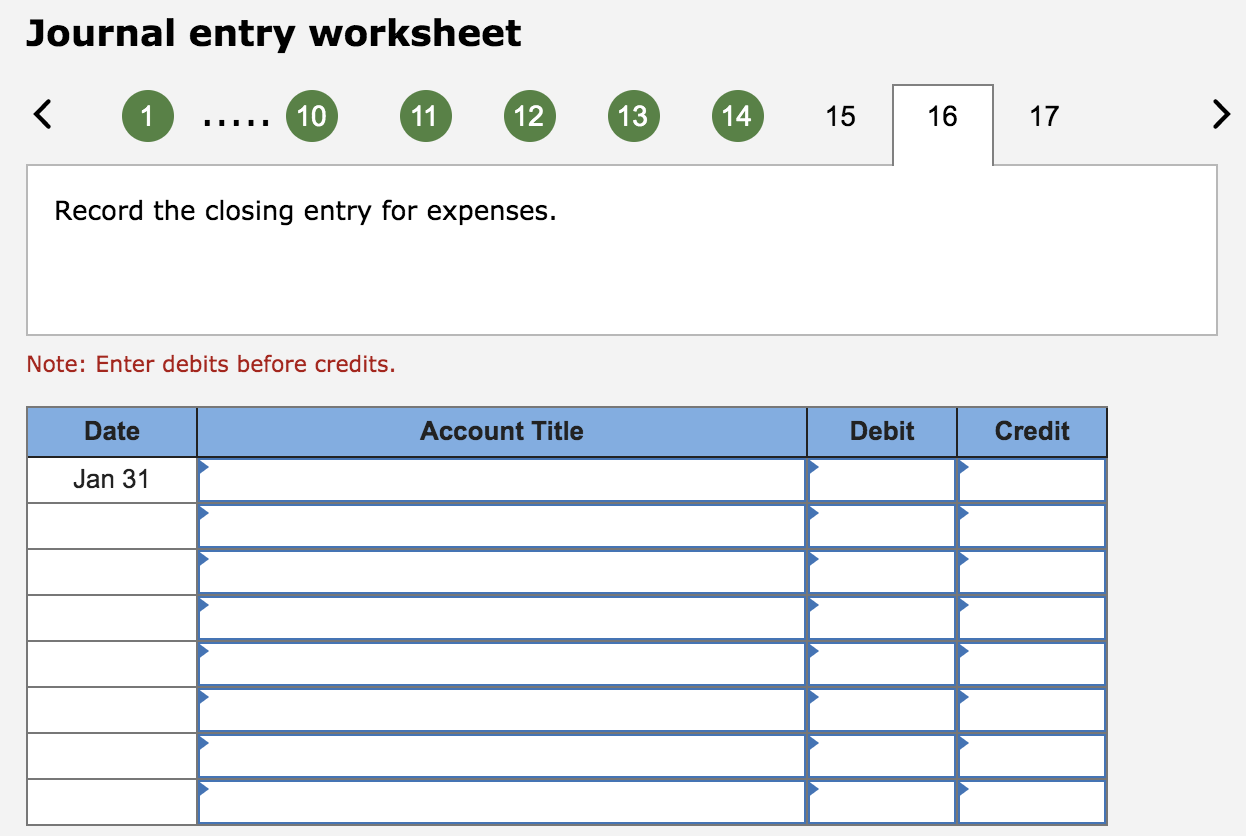

- Take note that closing entries are prepared only for temporary accounts.

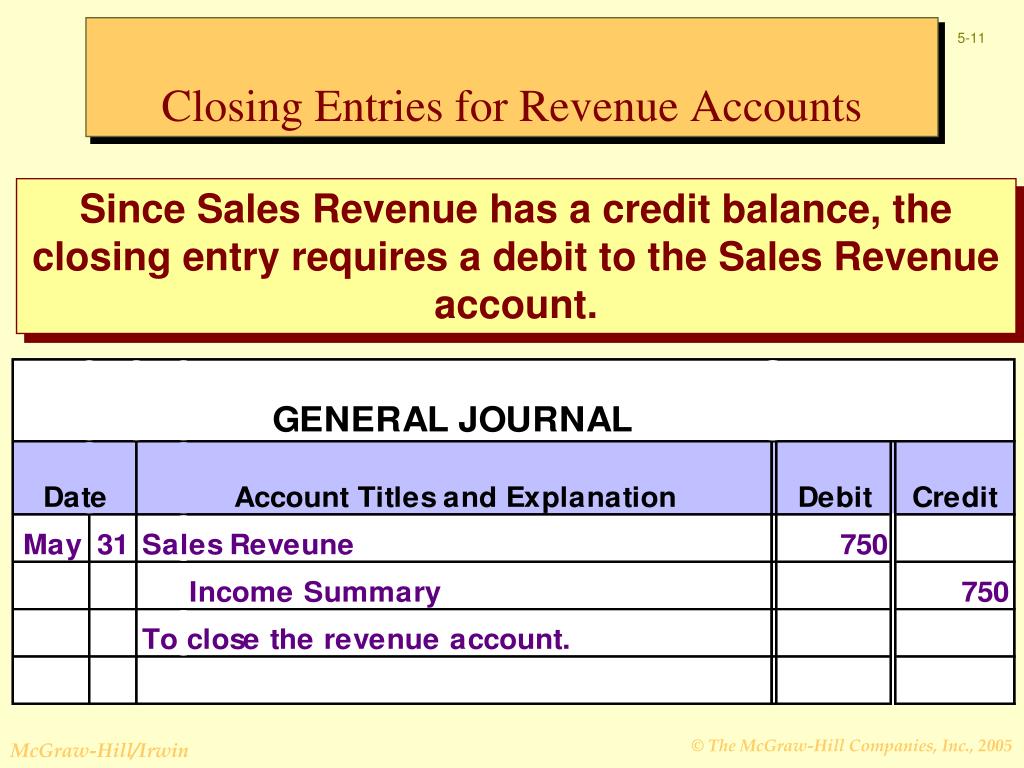

- The first entrycloses revenue accounts to the Income Summary account.

Financial Accounting

Notice that the effect of this closing journal entry is to credit the retained earnings account with the amount of 1,400 representing the net income (revenue – expenses) of the business for the accounting period. We see from the adjusted trial balance that our revenue accounts have a credit balance. To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement. Temporary accounts, also known as nominal accounts, are accounts that track financial transactions and activities over a specific accounting period.

What is Accounting?

This is the same figure found on the statement ofretained earnings. Notice that the balances in interest revenue and service revenueare now zero and are ready to accumulate revenues in the nextperiod. The Income Summary account has a credit balance of $10,240(the revenue sum). The eighth step in the accounting cycle is preparing closingentries, which includes journalizing and posting the entries to theledger.

Temporary accounts:

Check out this articletalking about the seminars on the accounting cycle and thispublic pre-closing trial balance presented by the PhilippinesDepartment of Health. Sum up the preliminary ending balances from the last step to make a trial balance. A trial balance is a report that adds up all the credits and debits in your business. You want your total credits to be the same number as your total debits—if they aren’t, go back and check your work.

What is the purpose of the Income Summary account?

In this chapter, we complete the final steps (steps 8 and 9) ofthe accounting cycle, the closing process. You will notice that wedo not cover step 10, reversing entries. This is an optional stepin the accounting cycle that you will learn about in futurecourses. Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7were covered in The Adjustment Process.

In other words, it contains net income or the earnings figure that remains after subtracting all business expenses, depreciation, debt service expense, and taxes. The income summary account doesn’t factor in when preparing financial statements because its only purpose is to be used during the closing process. Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account. This is no different from what will happen to a company at theend of an accounting period.

In order to produce more timely information some businesses issue financial statements for periods shorter than a full fiscal or calendar year. Such periods are 18 best hair growth products 2021 according to dermatologists referred to as interim periods and the accounts produced as interim financial statements. Interim periods are usually monthly, quarterly, or half-yearly.

We added it to Retained Earnings on the Statement of Retained Earnings. To add something to Retained Earnings, which is an equity account with a normal credit balance, we would credit the account. We need to complete entries to update the balance in Retained Earnings so it reflects the balance on the Statement of Retained Earnings. We know the change in the balance includes net income and dividends. Therefore, we need to transfer the balances in revenue, expenses and dividends (the temporary accounts) into Retained Earnings to update the balance.

While some businesses would be very happy if the balance in Notes Payable reset to zero each year, I am fairly certain they would not be happy if their cash disappeared. Assets, liabilities and most equity accounts are permanent accounts. Why was income summary not used in the dividends closing entry? Only incomestatement accounts help us summarize income, so only incomestatement accounts should go into income summary. All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary. Now that the journal entries are prepared and posted, you are almost ready to start next year.